Bills, receipts, and invoices are just a few types of accounting documents your business might be using regularly. There is an array of others such as proforma invoices, credit notes, prepayment invoices, estimates bills, and more. However, in this article, we will focus on bills, receipts and invoices as many users get confused on their differences and which one to send out.

What is an invoice?

In simple words, an invoice is a document a business issues to customer. It states sold products or services and the amount of money to be paid. Invoices serve as a request for payment and are sent before a customer makes a payment. They are used to effectively keep track of the sold items, their prices, taxes, and other transaction-related information. Usually, invoices are issued after the service or goods have been delivered while the payment has not been made yet. Invoices were widely printed and sent via post or fax in the past. However, in 2021 and beyond, online invoices sent in a pdf format via email are a more cost-effective, convenient, and more eco-friendly solution. Keeping track of invoices with one unified invoicing system helps reduce administration around accounting and reporting.

What is a bill?

A bill states the due amount to be paid by a customer. When a business sends an invoice to a customer, a customer has to input the invoice information in the form of a bill in their booking system. A bill is created before payments.

What is a receipt?

A receipt is a confirmation of a payment. This document confirms a customer has received the goods or services. A customer can use a receipt a proof of a completed payment for goods or services. Receipts are given to customers in a digital or paper format after the payment has been performed. This document is common for both traditional and eCommerce businesses and is an important proof in case any issues with the product appear. A seller is using a receipt to verify if the claims for exchanging or returning goods are justified.

Invoices, bills, and receipts: key differences

The main difference between an invoice and a bill depends on who is sending the document. The document is being sent out from a business or individual (such as a freelancer) to another company that it is seeking compensation from, then it is an invoice. However, the recipients of the invoice or the company that gets invoice refers to the invoice as a bill or can create a separate bill showcasing the transaction and recording it in its books.

The other main difference between these two terms is that when an invoice is sent out, the company or individual is asking for payment and often giving the customer a deadline or payment terms on the invoice. On the other hand, a bill is recorded immediately after a payment has been made or right up front during the time the service or product is obtained and payment is processed.

Think of going shopping and receiving a bill from a store. The store owner wants to be paid immediately rather than invoice you and expect a payment at a later date.

A receipt, on the other hand is proof of payment. It is not a bill for the payment or an invoice where the payment is due at a later date, but proof that it has previously been made (the payment). Thus, it is similar to both an invoice and a bill, but the payment has already been conducted.

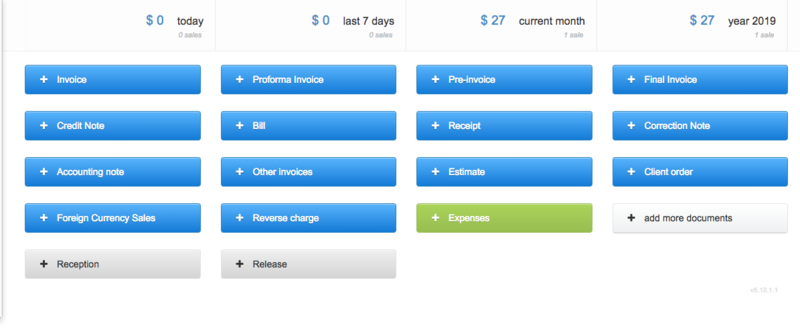

As you see it is easy to confuse all of these three terms, but there are some clear differences to watch out for. It is worth also remembering that our system offers all three options for you to use if you choose.

How to issue invoices?

If you are going to use an invoicing software to issue an invoice, you would need to fill in a few details.

Here are the main details:

- Seller's information (Your company' name, VAT ID (if applicable), your company address, bank account and SWIFT to which a payment has to be made)

- Buyer's information (You client's company name, VAT ID (if applicable), client's address)

- Invoice entries (product names, quantity, net prices, tax rate

- Payment details (payment type, due date, PO number)

- Currency, exchange rate (custom or national bank's)

To save time for generating invoices for the same clients in the future, you can create a client in the invoicing software and pre-populate invoice information.

Apart from one-off invoices, you can also create recurring invoices and send them at a specific day of the month.