Entrepreneurs are facing at least some of these challenges when starting a business – finding a niche market, setting up operations related to launching a business entity, dealing with a lot of paperwork, and last but not least, getting clients to pay on time.

The latest aspect is critical to your business cash flow and may raise a few questions such as:

- Do I meet all the requirements when issuing my invoices?

- What can I do to get clients to pay faster so that I can pay my employees?

- How can I avoid uncomfortable conversations over unpaid invoices?

In this article, we will try to dispel your doubts and show you solutions to make managing your business invoicing easier and get your clients to pay faster.

What invoicing challenges do new entrepreneurs face?

When launching a global business and looking to cooperate with clients from all over the world, accounting and invoicing can get more difficult. That is because you have to account for the local regulations of your counterparts and know their invoice requirements.

For example, information on invoices or tax rates may vary from one country to another. Tax rates in Poland are the same for the whole country. In the United States, they may differ from state to state due to states’ federal structure.

Keeping in mind all these specifics can get more complicated when you don’t have an in-house accountant to help you out.

Fortunately, there are many options to make your first steps with accounting easier, sell your products at fair market prices, and streamline the paperwork! We will dive deeper into how you can automate the process of sending professional invoices a bit later in the article, so keep reading.

However, let’s first see what makes a perfect invoice.

You know what an invoice is, right? It doesn’t need a general description. However, do you really know it by heart, what information a perfect invoice should contain? Let’s refresh this term for you in all details.

What is an invoice?

An invoice is a document that confirms a transaction between two parties – the seller and the buyer. It is the most popular document confirming sales.

Your invoice should contain detailed information on the completed transactions, such as information on the products or services sold, details of the parties involved or payment deadlines.

What should an invoice contain?

An invoice is a document on which you can observe a certain repeatability. There are some details that you need to enter almost every time, such as the name of your company or the data of a client you frequently send invoices to.

It is worth having them ready at hand to enter them on an invoice or save them in an invoicing software to avoid entering them manually every time.

Often, businesses make mistakes when sending invoices resulting in their clients getting confused. Forgetting to specify invoice due date, adding a note on shipping or a wrong tax – those are just a few examples.

So what is a recipe for a perfect invoice and what data should you include there? Let's sneak a peek!

General information:

- invoice name

- invoice number

- issue date

- sale date

- due date

Your company and your client’s data:

- your company details such as business name, address, street, city, zip code, contact information etc.

- name and address of your client

Product description:

- descriptions of products and services sold, their quantity and price

- net price, net value, VAT % (if applicable), VAT amount, gross value

- the total amount owed

In addition, it is worth adding your company’s logo, seller’s and buyer's identification numbers, their signatures and payment methods.

The purpose of issuing invoices

Whether you are self-employed or are a small business owner, sooner or later, you will definitely encounter invoicing. Invoices are an inseparable part running your own company, yet hardly anyone wonders for what purpose this type of document is actually issued.

As an entrepreneur, you should document each sale of products and services as well as their purchase. An invoice is a kind of contract between a buyer and a seller, it confirms the legality of the transaction.

Having a confirmation of transactions, both parties can feel more secure in the event of further claims regarding the purchase - such as complaints or return of a given product.

Thanks to invoices you can also avoid misunderstandings and fraud attempts. Having confirmation of purchase in two copies – yours and the buyer’s – you always have a documented purchase of a given service to which you can always come back.

Using invoices, it is also easier to keep track of all transactions and the status of the payment. You can monitor whether your client has paid all receivables or whether it is in arrears. It also helps with managing the cash flow of your business.

Why is it important to construct a professional invoice?

If you want to grow your business and reach more clients, it is worth taking care of all aspects of your brand.

By creating invoices that are thoughtful and tailored to both your and your clients' needs, you will gain their trust faster making your company look more professional.

Professional-looking invoices attract attention and give a feeling that you attach great importance to the company's branding. Your customers will definitely appreciate the ability to choose the color of an invoice or add a logo.

How to make an invoice?

When you run your own small business, it is a good idea to refine invoicing. After all, you are dealing with them all the time. To get started with invoicing, you need to keep in mind a lot of small details to send your invoices on autopilot.

What are the most important steps of sending an invoice?

1) Choose a template or invoicing software

An invoice may be in paper or electronic form. It should be issued in two copies - one for you and one for the buyer.

If you want to issue an invoice, you can use online invoice templates - just choose the most suitable template and download it. This is a good solution if you are just starting out with your small business and you don’t need to issue many invoices.

The second option is to use automated invoicing software that will significantly streamline the invoicing process. These will work great if your business is growing and you’re gaining more and more customers - and thus you’re issuing more invoices.

No commitment. No credit card required.

Start 30-day free trial

2) Fill in the templates with the most important data

Enter the relevant details of your company and data of your clients’ names, addresses or contact information are important here. These will make it easy for your customers to contact you if they have questions. Always double check whether you've put the correct data.

Add appropriate products or services to your invoice, their quantity and prices. Make sure to include the total amount owed. Add each product to a separate section so your clients have a clear and transparent display of what they are paying for.

Make sure you have indicated on the document that this is an invoice. Clients seeing what document they are dealing with will pay you faster. Also remember to include an appropriate invoice number to keep your paperwork organized and to be sure that you’re not creating a duplicate.

3) Don't forget to enter key dates

If you want to keep your documents in order and get paid faster, it is worth taking care of entering the correct dates on the invoice.

The primary date is the issue date. It documents the date when the invoice was created. In invoicing software, it is added automatically.

Due date is also very important. It indicates the day by which the client should make the payment before the payment is considered overdue. The due date is up to the person issuing the document, but it must contain a specific date.

4) Payment methods

Different customers may have different preferred payment methods. Ensure to give them the opportunity to pay for the invoice in the way that suits them best - this should help with your business cash flow, as it will speed up the time in which you receive the payment. Consider such methods as payment via check, credit card or bank transfer.

Additionally, it is worth integrating payments in invoicing software with payment services and adding a 'Pay online' button on invoices to allow clients to pay for receivables in minutes.

5) Send the invoice

Once you’ve finished creating the invoice and made sure that all entered data is correct, you can move on to sending the invoice.

Shipping by traditional mail is a good solution when your customer does not use email.

However, sending your invoice online by email, will be a quicker option. You can send an invoice in PDF format, add attachments or a short comment addressed to the customer.

Sending invoices through an online invoicing software is another option. As with emails, you can often add attachments, a short note, and you can send the client a secure link through which they can access the invoice.

6) After you send the invoice

Unfortunately, sometimes the invoice gets damaged or lost. So it’s a good idea to stay in touch with your client in case of problems.

If you use an invoicing program, after sending the invoice to the customer, it is worth tracking its status. Monitor whether the customer has received the invoice, if it has been paid or overdue. For overdue invoices, sending reminders to clients is considered a good practice.

Invoice templates in Word and Excel

As a small business owner, you do not necessarily send many invoices right away. In this case, you won’t need more than just one good invoice template in Microsoft Word or Excel.

You can easily customize their look to your own needs – company brand colors, fill in the fields with your company’s and client’s information or add your company logo.

All you have to do is download the templates of your choice, fill it out and send invoices to the client! In our system, you will find free templates adjusted to some of the most popular programs such as Microsoft Word, Apple Pages, and Google Docs. They contain everything to help you get paid faster by clients.

However, if you issue a lot of invoices every month and want to create a more professional invoice, automated invoicing software may be a better solution for you.

Invoicing software

Manual invoicing can get time-consuming very fast taking time from more strategic, high-value tasks. The desire to reduce working time should be a big motivator if you want to focus more on the work that contributes to your company’s growth.

When keeping all invoices on your hard drive, you can also get lost searching for a specific invoice among many other documents. That should motivate you to switch to automated invoicing as well.

Let’s see the biggest advantages of invoicing solutions.

Benefits of using an invoicing software

1. Less work

With an automated system, you will issue and send invoices to your customers in the blink of an eye and increase the efficiency of your company management. The system records the previously entered data, so you do not have to enter them manually each time you issue the invoice.

2. Keep track of invoicing

Have you sent an invoice to a client and still not received payment for it? You can set the system to automatically send reminders on unpaid invoices to your customers so you don’t have to keep bothering to send them manually.

3. All documents at one place

No more worrying about lost or damaged documents - issued invoices are saved in the system, so you can always come back to them.

4. Access to documents from anywhere

Are you away from the place where you keep your invoices and need urgent access to them? Not a problem! With an automated invoicing program, you can access your documents from anywhere, even from your mobile phone - all you need is access to the Internet!

5. Quick invoice search

Need to find a particular invoice? With invoicing software, you can find any documents by searching for them by keywords - such as client data or invoice number.

6. Lots of templates to choose from

Make your invoices more diverse and interesting! Choose the invoice design that suits you best and fill it out according to your needs.

7. Receive money faster

Want to receive payments from your client faster? Integrate your account with payment systems and add a Pay online button to your invoices. This will allow your customers to pay for products and services they purchased in moments.

8. Changing the currency on an invoice

No more manual recalculation of receivables! With the help of invoicing systems, you can issue invoices in all currencies of the world that will be converted according to the set exchange rates.

9. Recurring invoices

Do you regularly send your invoices to the same clients? For examples, SEO agencies usually work with their clients on a retainer basis. Instead of sending the same invoices every month, automating this process is the way to save time. That should apply to your business as well!

10. Multilingual invoices

Create invoices in your clients' language. With just one click of the mouse, the system will automatically change the invoice language.

11. Bilingual invoices

Do you issue invoices to foreign customers? Facilitate the communication by setting up bilingual invoices in any combination of available languages – e. g. English-Polish, English-German, German-French etc.

12. Add your accountant

Streamline your paperwork - instead of consulting your accountant in every case each time, invite them to cooperate with you from your invoicing software.

13. Client panel

Keep your documents in one place and make them available for your clients in one online spot! Setting up a client panel will help you solve this challenge. Your customers will appreciate the easy of accessing documents.

By using a client panel, you will gain customer confidence and your company will look more professional.

14. Taking care of the environment

Paper invoices are a thing of the past! Using invoicing software, you can do everything online, so you reduce the number of printed papers. This makes you more eco-friendly! In addition, by avoiding printing your documents, you save money.

Types of invoices

There are different types of invoices, you should know about as a small business owner. Here are the 5 most common ones.

Sales invoice

A sales invoice is the most popular type of invoice. It confirms the sale of goods and the transaction. Usually, the sales invoice contains a description of the product sold, the amount owed, and the payment deadline.

Proforma invoice

A proforma invoice is not a sales document and that is why there is no obligation to pay for it. Usually, a proforma invoice is sent to the customer before sending products or delivering services. It is used to inform the client about the price of future transactions, the possibility of an advance payment or prepayment.

Recurring invoice

You create recurring invoices for regular payments. If you send invoices to the same clients, you should give recurring invoices a try. They work great if the client pays you every month, for example by paying the subscription for your services.

Prepayment invoice

A prepayment invoice is designed to confirm the payment of an advance/prepayment before delivering goods. This invoice confirms that the prepayment has been received in part or entirely. It is generated to secure the transaction.

Final invoice

The final invoice is created when the project has been completed to request a payment. You should normally use it when your client hasn't paid a full price for the project before. Final invoice indicates that no further invoices will be sent.

How to choose the best invoicing software?

Now that you know the advantages of invoicing software, now it is time to choose one.

Consider how much you are willing to spend on a subscription and what you need the system for – after all, it should be tailored to the needs of your business.

Do you only need it to create basic invoices or want additional features, such as the possibility of sending bilingual invoices? Think of what you require from such a program, compare the functions and prices in different plans and select the most suitable system for your business.

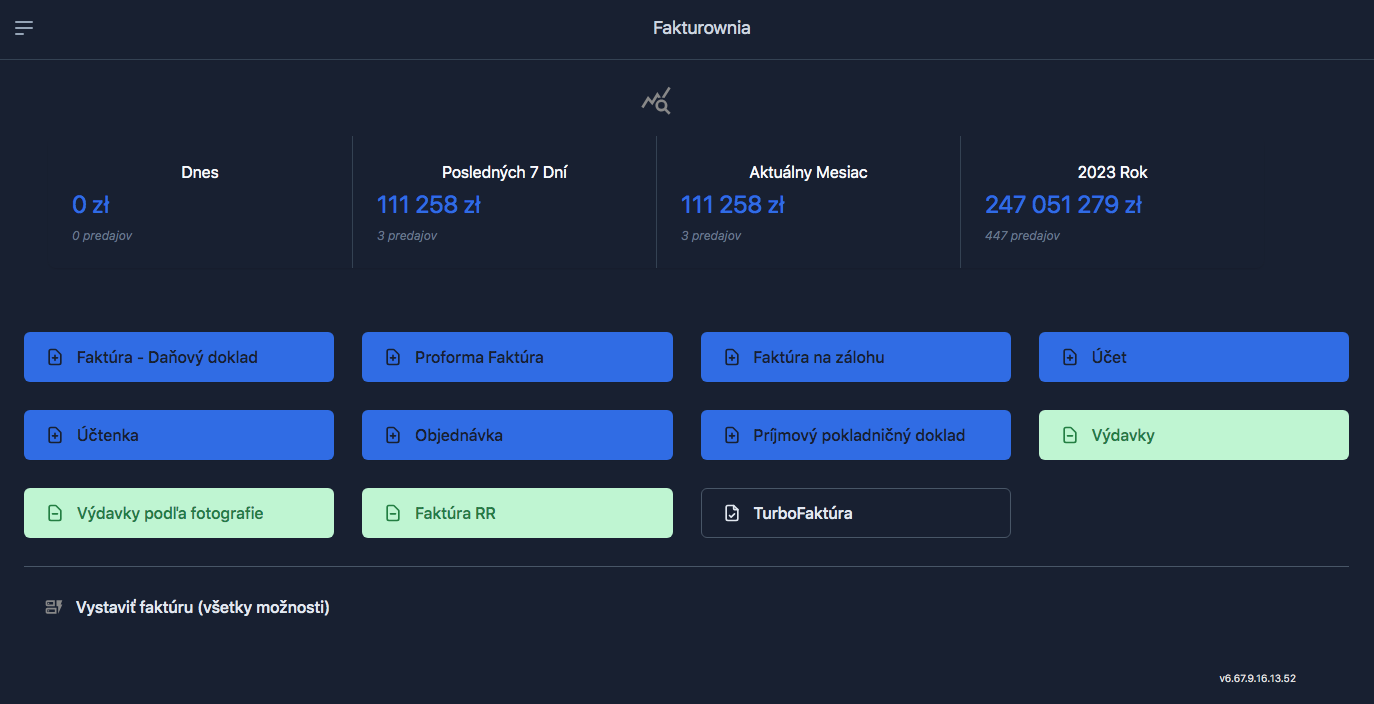

InvoiceOcean Plans

When choosing a system to work with on a daily basis, it should be convenient. Test if the system interface is intuitive and if you are comfortable working with it.

Since it’s mainly about sending invoices, you should be able to generate as many invoices as you need on a monthly basis.

You can check some tips on choosing invoicing software before making a final decision.

What else should be kept in mind when issuing invoices? A few more tips on invoicing

- Try to include all necessary information on the invoice to get paid by the client. Keep your invoice concise.

- If you want to include more information on the invoice, you can add some notes or attachments before sending the invoice to your customer.

- If your client speaks a different language, you shouldn’t necessarily translate your invoices. In the case of sending foreign invoices, bilingual invoices are a good idea.

- Create invoices in two copies, one for each party - the buyer and the seller of the products or services.