How can you get your business running if clients don't pay on time?

As a business owner, you are putting your cash flow at risk, but here is the truth — your clients can forget to settle a payment on time. Haven't you forgotten to pay your invoices once?

Forgetting to pay an invoice can happen to anyone, but thanks to a good payment reminder email, it shouldn't be a problem for your business.

Payments are a little bit of a touchy subject — who enjoys all those uncomfortable conversations like "Would you please pay that week overdue invoice?"

Also, nobody likes to be called out as a client not to be trusted. This is why writing a good invoice payment email is not that easy.

Writing and delivering an effective payment reminder email goes much beyond choosing the best time to send an emailand the best words to use to let your customers know without insulting them.

But let's see how you can word that fair request without it sounding like an unfair demand.

Payment Reminder Email Essentials: The Hows and Whys

Being too vague regarding payments and payment deadlines could imply that the client can proceed after receiving your product even weeks or months after.

So, if you've completed what the customer asked of you and if the customer has received the goods and is alright with their quality, here's how you can make your life easier.

Step No.1: Set Up an Automation Tool

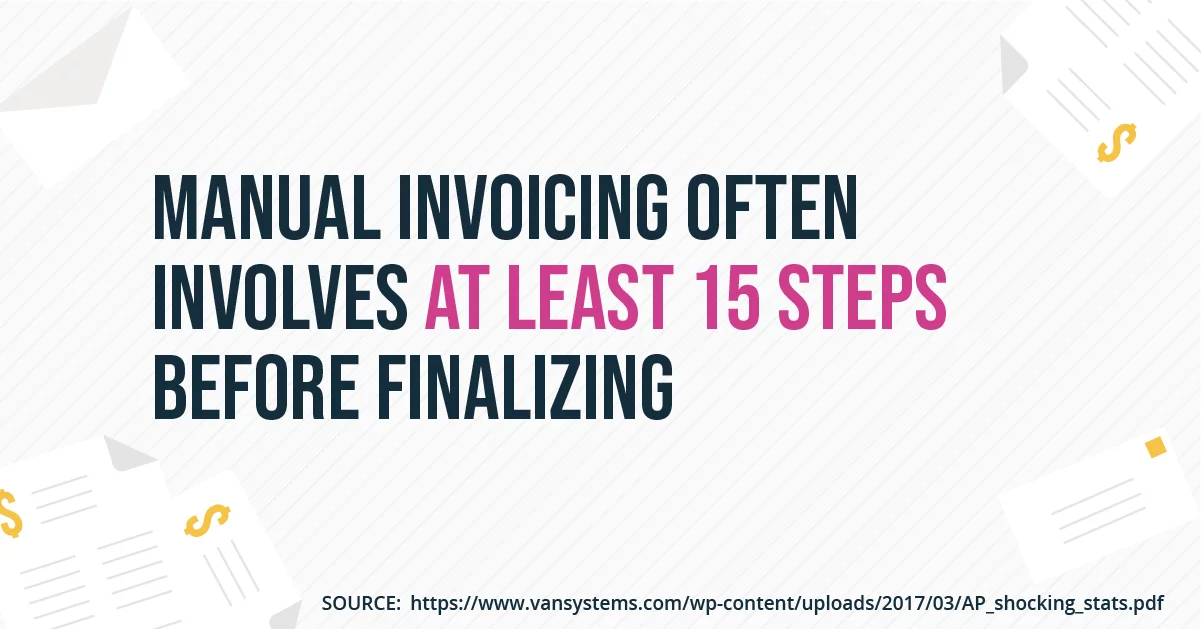

Before you send an invoice, you usually go through 15 steps to create a document.

(Source)

What if you are sending dozens of invoices?

As your business grows, this tedious task of creating invoices will only consume more time in the future — the time you'd better spend on developing your business.

The same goes for sending a payment reminder email for the unpaid invoices.

Firstly, you will need some time to create an outstanding payment reminder email for each client.

Secondly, sending a late payment reminder email when the payment is due can easily slip your mind.

Here is the thing — you can't control everything, especially repetitive tasks.

But don't you worry — there are ways to help you reduce time on creating payment reminder emails. That's where an invoice automation tools comes in handy.

Using InvoiceOcean you can save you time on setting up your reminder emails and send them automatically when the due time comes.

To make the process of writing a reminder email faster, you can use an email template builder tool.

Forever free for small business. Cancel anytime. No credit card required.

Start 30-day free trial

Using payment reminder email templates with invoice automation?

Late payment reminder email templates need to include some specific pieces of information that you'll be able to change accordingly each time you have to edit and send it — hopefully, it won't be too many times. A good template that works is more than just a reminder email.

Make sure you include an invoice number related to the overdue payment, the date the client received the product or service, the amount due, the payment date, and, of course, your contact details.

The benefits of automating invoices and payment reminder emails

Workflow automation tools allow for more time to tackle important issues.

Using an automation tool to create invoices and late payment templates will help you streamline the process while minimizing the possibility of human error.

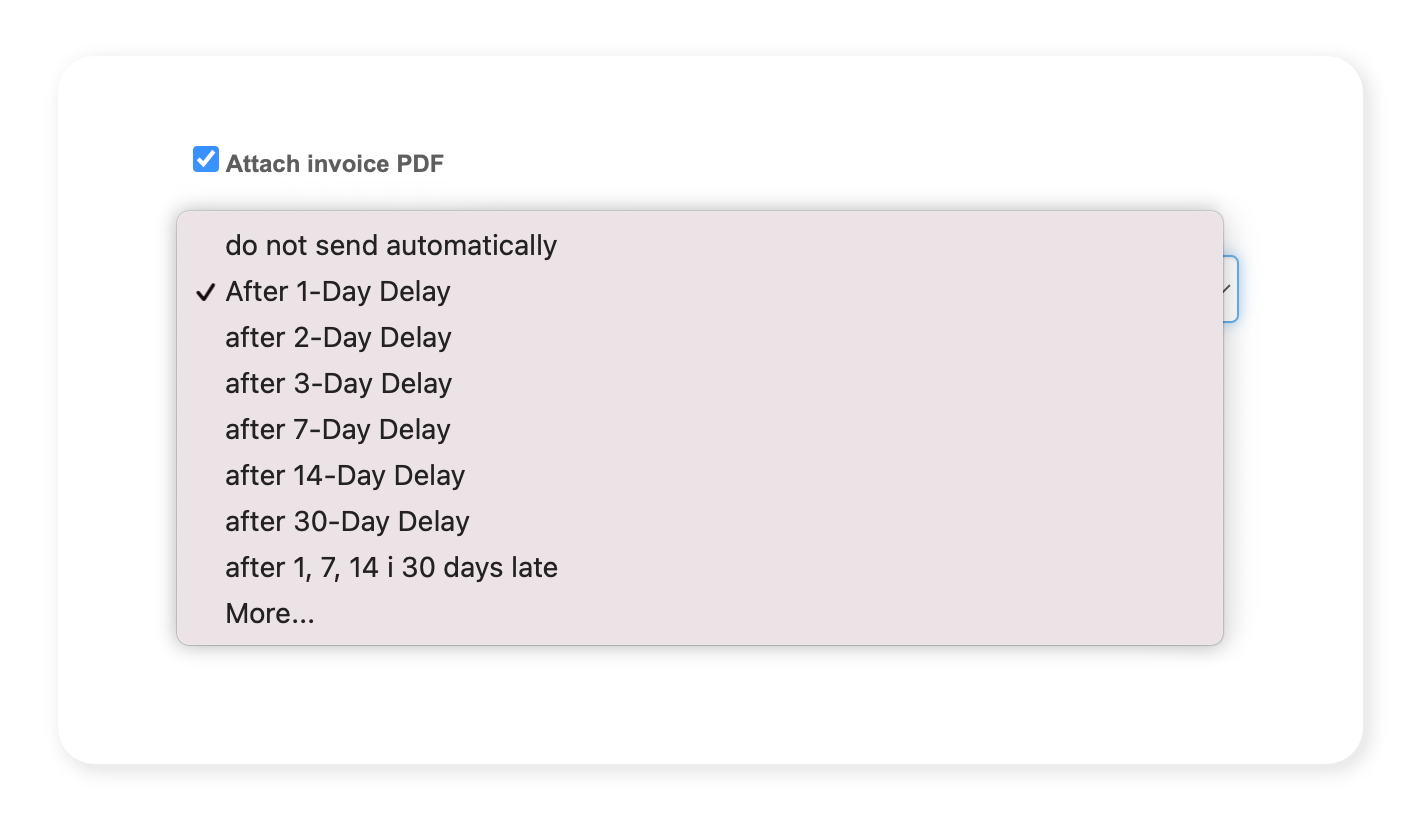

In InvoiceOcean, you can easily set up reminders for overdue invoices, so you can integrate your invoices with email without going for a separate email automation tool.

You can define a 1,2,3,14-day delay for sending payment reminders after a due date of your invoices.

When it comes to payment reminder email copy, you can set up a custom message with invoice details recorded as dynamic fields — you don't have to add them every time you send a reminder email to your client.

Step No.2: Create Different Templates for Different Reasons

Not all situations are the same, of course. This means that you will need to create different templates of payment reminder emails for different situations.

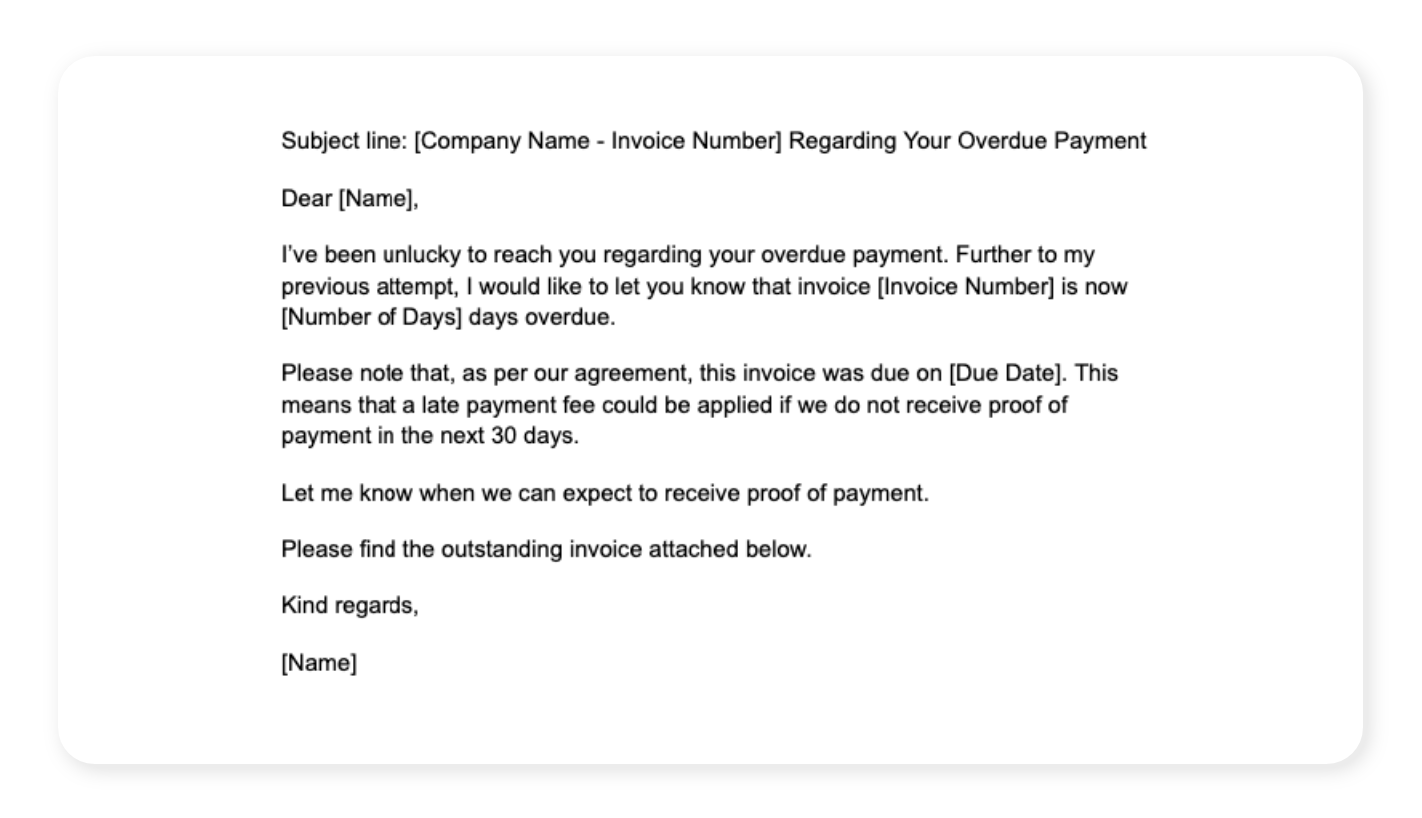

The first reminder email

Let's take things chronologically.

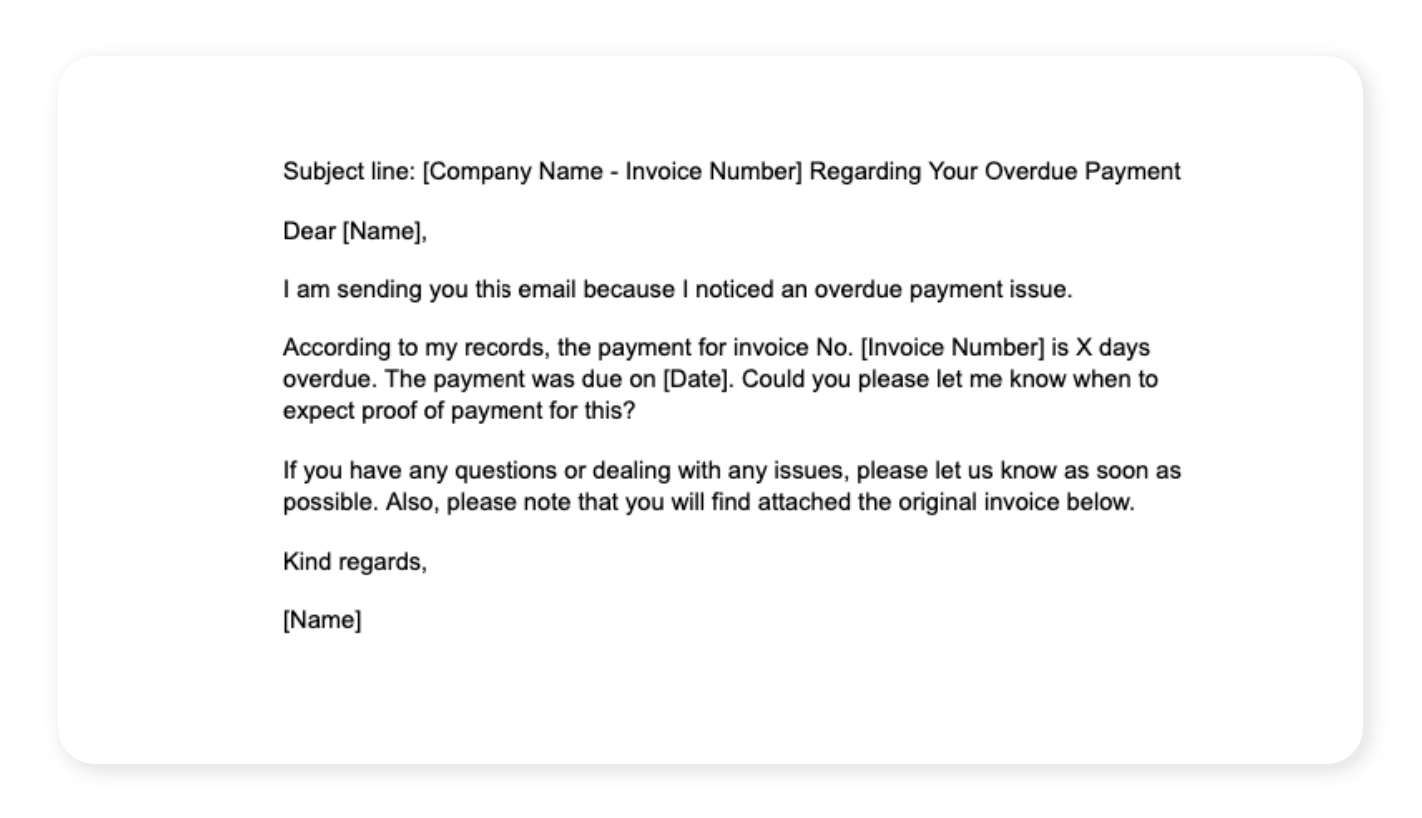

Your first payment reminder email should be a polite reminder sent to your client directly. This friendly payment reminder letter should be used when clients delay payment for no more than fourteen days, and it should look something like this:

Most likely, your customer will proceed with an online payment or bank deposit right on the spot if you include payment details.

More often than not, people forget, and emails could get lost or ignored.

Pro-tip. If you want to receive payment faster, consider adding Pay Online button on your invoice and integrating with a major payment provider. In InvoiceOcean, you can integrate your payment button with Stripe or PayPal.

As you can see from the example above, the tone is not strict; it's conversational and respectful, and it seems like it takes the possibility of human error into account.

After all, fourteen days or less is not that big a deal.

The second payment reminder email

It could be a big deal if your customer doesn't get back to you for more than that, though, which marks the time for your second outstanding payment reminder email.

In this case, you can send a payment reminder similar to this example:

The second and follow up email is still a friendly reminder. At this stage, a late payment could harm your business — SMB, freelance writing, design projects, anything — and you need to use a tone that could reveal that.

Don't be afraid to be firm, and don't be afraid to remind your client of every little detail.

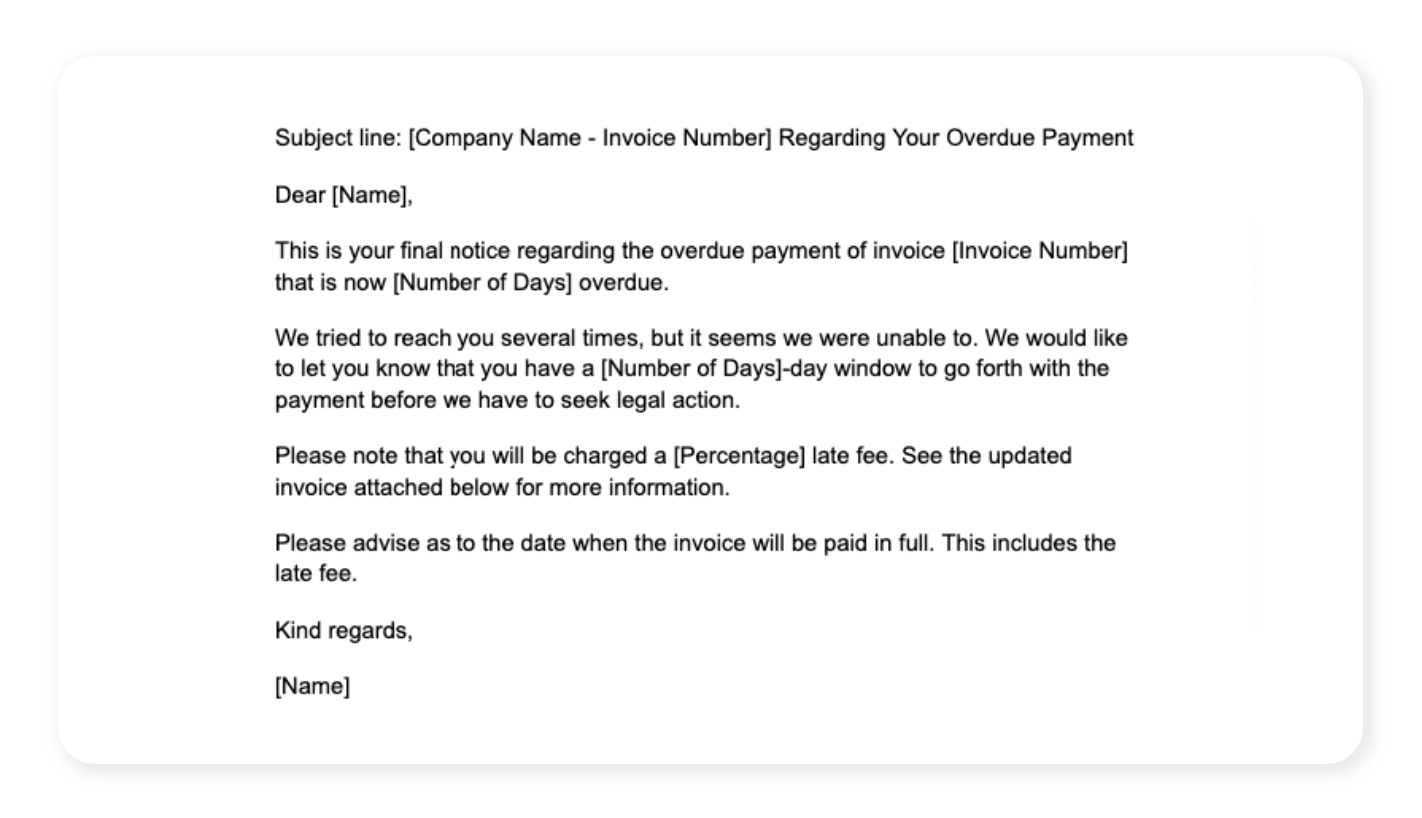

The final payment reminder email

If this doesn't work either and a client doesn't send payment immediately, we get to our final late payment reminder email, which needs to be the strictest one of the three.

Use this invoice reminder template if the client's payment is more than thirty days overdue.

As you can see above, this is the final warning before your client faces legal consequences.

In this invoice reminder, make sure to use language that will pinpoint that, point out any extra charges such as a late payment interest fees or interest charges.

Again, be thorough with dates and send this email as a reply to the previous two.

The point is for the customer to understand that when you were showing off your work — whether it was a product your SMB carries, your design portfolio, or even just a consultation at your freelance venture — you made an agreement with them.

This agreement included a price tag that was not optional and should be evident from the first late payment reminder.

Using the right wording with invoice reminders

It's best to keep in mind that your wording doesn't always need to be strict, especially when the payment is not that long overdue.

Words can make a huge difference and motivate people, so:

-

Make sure to be as neutral as possible - strict doesn't mean annoyed or frustrated, after all.

-

Be firm and business-like, especially in the last two cases.

-

Mention legal repercussions when you get to the final email, but not sooner than that - you don't need to sound threatening.

-

Don't beat around the bush and use your copy to get straight to the point from the moment you compose your subject line. Include the invoice number and the phrase "unpaid invoice reminder" in your email subject.

Step No.3: How to Avoid the Spam Folder

What happens when your emails end up in the spam folder, and you can't get a hold of your client because of that?

In that case, your late payment is neither your client's fault nor yours.

The reason why some emails go to spam can be because of your wording — using words like "MONEY" in all caps, for example, can trigger spam filters. But what can you do to avoid the spam folder altogether?

1. Don't use trigger words in late payment reminder emails

First of all, you need to avoid trigger words and phrases. Spam filters target promotions, so if your email's copy or, worse, your subject line is written in a spammy way, the client's spam filter will send payment reminders right to this folder.

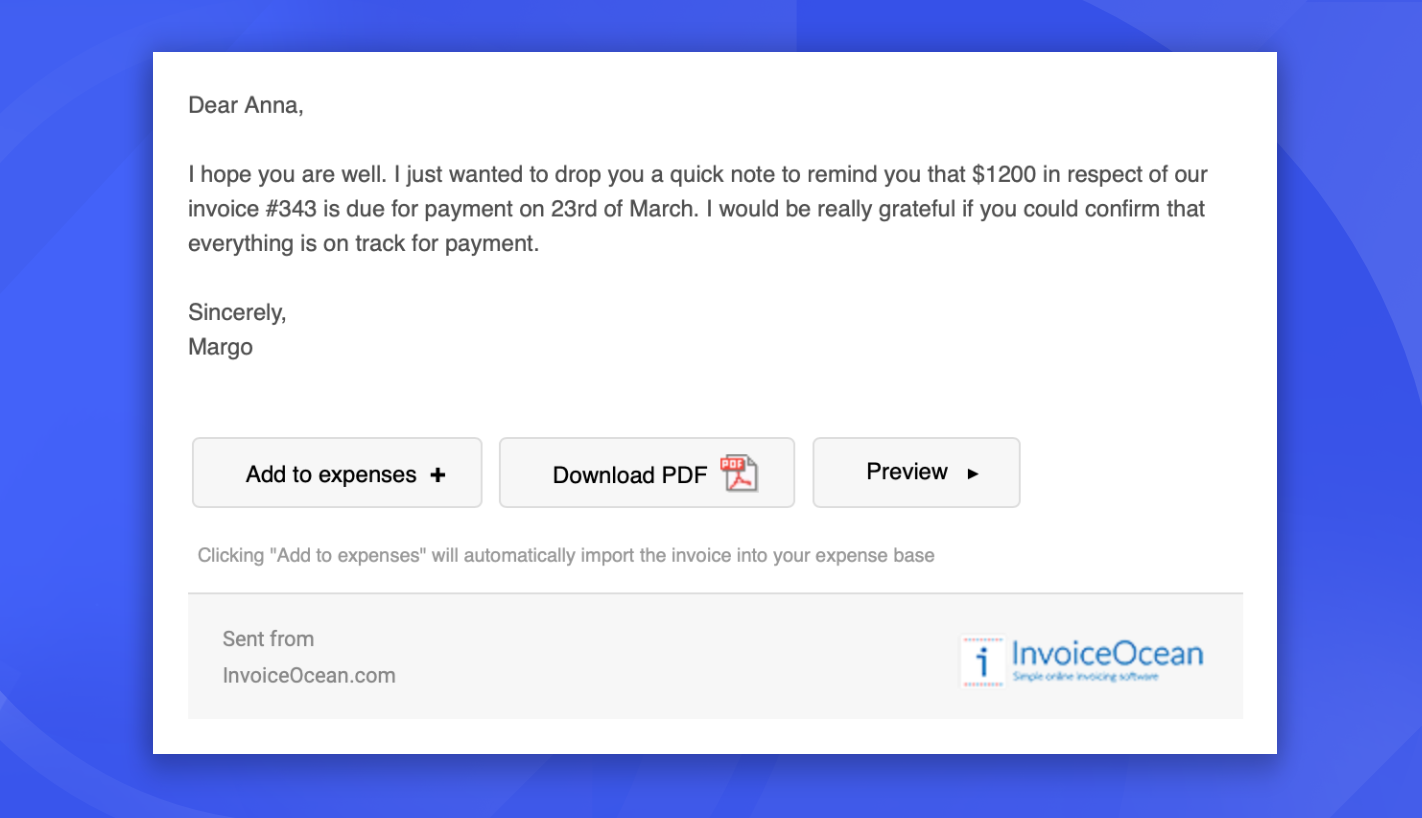

2. Use attachments instead of links when sending invoice reminders

Another issue would be using links and combining them with trigger words. Linking to it and asking for payment could very well look like a phishing scam.

It's best if you attach the late payment invoice to your email.

When sending your late payment reminders, here is how your attachments look like in the email body.

3. Use a trust ESP for your payment reminder emails

Invest in a trusted ESP with good deliverability rates.

After that, compose a subject line that will be grammatically correct, won't include exclamation points, capital letters, or the words "MONEY" or "URGENT".

4. Improve the formatting of payment reminders

Also, make sure to check for typos and grammatical errors. Your formatting could also send you straight to the spam folder.

Step No.4: Should You Take Legal Action?

The truth is that you should if your customer ignores your email reminders on the payment due.

However, this can be a strenuous process. And it will bring your relationship with the client to an end.

Legal action should be the last resort, and you should go forth with it only if there is no other solution available. Otherwise, it will be bad for your reputation, especially if you're a freelancer.

What can help avoid legal action?

To avoid legal action:

-

Make sure that your client has indeed received your email first.

-

Give them a call, introduce yourself and ask them whether they've received your invoices.

-

Try to be polite and collected, and double-check the email address you have. If it's the correct one, tell the customer to stay on the phone while sending the late payment notice again.

-

Make sure they confirm that they received the notice.

You'll see that sometimes, the only reason why your payment is long overdue is because of technical issues or simple miscommunication.

And if you can't get a hold of them over the phone, a simple text message could work — just make sure you're familiar with your country's text messaging laws.

Sometimes, a text message can be more welcome than a call, as it can prove that you have tried to contact your client several times. This can be valuable in case things do go to court.

Step No.5: The Pointers to Follow in General

In SMBs and freelance ventures, late payments are sometimes inevitable. However, there are some things you can clarify upfront.

-

Don't rely on the customer reading the repayment "fine print". Point it out yourself. Repayment terms are not open to interpretation, and you should be clear about when the first (second, only, etc.) deposit is due.

-

Send your invoice straight after providing service. If your client bought the goods from an eCommerce store, they would be asked to pay at the checkout, where they would also be informed about the store's return policy and payment options.

It would help if you did the same and had your invoice ready to be paid right on the spot. It's more likely for the customer to complete the transaction right after they've received the goods.

-

What is your payment timeframe? Discuss it beforehand. I think this is pretty self-explanatory. Again, timeframes are not open to interpretation, so you should be very clear about when your repayment period starts.

You can discuss this with the client when talking about the specifics of your work and let them know that the invoice is "Due X days after receipt" both beforehand and upon receiving your invoice.

-

Incentivize timely payment with a discount. All professionals use this, and it's a measure that works. And you can get bonus points and timely payments if you charge a late payment fee.

If these sound scary, you can always simply ask for an amount of money in advance. That way, you will attract clients who will pay you in full after you're done.

The Takeaway

Overdue payments can be a real bummer and can stump your business's growth. However, sometimes it's just a matter of being too swamped to remember financial issues.

Keep that in mind when writing a late payment email, and always be clear and upfront about what your service offers and the repayment timeframes you're accept.