Formula - Break even point in a nutshell

Use the following formula to calculate break even point:

Break-even point formula (unit sales)

Break even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

Break-even point formula (sales dollars)

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Why do you need these formula?

For new businesses, reaching a break-even point is a critical milestone insuring a business can cover its total expenses and is at a point to start making a profit. If you have just started growing your company, you might be asking yourself "When does my company break even? What is the right price for my product? Should I charge more or less?" To answer these questions, you have to start with the basics – a simple financial analysis and calculating your break even.

It's crucial to determine your fixed costs (such as employee salaries) and variable costs (materials) you need for production of services. By determining those, you can come up with a better (and more precise) pricing for your product that accounts for your expenses and units you need to sell to start making a profit.

What is break-even point?

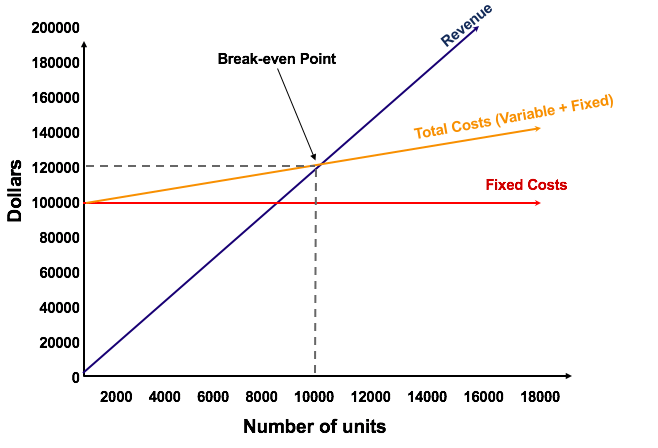

Break-even point is a situation where business costs and total revenue are equal. When doing a break even analysis, one should calculate units or dollars needed to cover company expenses.

In simple words, you have to look at the costs that remain the same every month (for example, renting an office) and the costs of producing your product (for example, the cost of materials).

How to calculate? Formula – break even point

There are at least two formulas you can use to calculate the break even.

Both formulas focus on two different metrics:

1) number of units of product sold

2) points in sales dollars

How to calculate the break even point (unit sales) – number of units of product sold

Break even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

How to calculate break-even point (sales dollars) – points in sales dollars

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

There are few elements of these formula that definitely need a bit more explanation. So let's look at the definitions and then proceed to some real life example to help you make these calculations by yourself.

No commitment. No credit card required.

Start 30-day trial

Definitions of the formula

Fixed costs are your business costs that stay the same month by month. They can represent salaries, the cost of renting an office space, or outsourcing accounting.

Sales price per unit is how much a product you are selling costs.

Variable cost per unit is the cost of creating one unit of your product.

Contribution margin is the difference between the price of product and its variable costs.

How do I use break-even analysis?

So now you have the two formulas to use. Let's have a quick look at the interpretations and examples.

Interpretation of break even analysis

At break even point, a business doesn't make any profit or loss. It produces enough revenue to cover business expenses.

A business is at a loss when revenue is smaller than a total of variable cost and fixed cost.

Let's say you produce sweets. Your total variable costs are $1000 and total fixed costs are $10000, and you managed to earn $5000. In this case, your business is at loss because the both costs ($10000+1000=$11000) exceed the revenue - $5000 making a difference of $6000.

A business is profitable when the total variable cost + fixed costs are smaller than your revenue.

Using the same example – the costs of producing sweets is $5000 (both fixed and variable), while your revenue is $10000. Your business has covered the costs and made a profit of $5000.

Break-even point – is revenue equal costs (both variable and fixed). If you spend $5000 to produce and sell sweets and manage to earn $5000, your business is neither profitable nor at a loss – it's reached its break-even.

What is breakeven point – example?

The cost of producing a kettle is $15 – it's a variable cost.

The price at which you sell each kettle is $100 – it's selling price.

The difference between variable cost and selling price equals $85 and makes the contribution margin and this money is used to cover the fixed costs.

Let's say your fixed costs are $10000 all together.

The break-even point would be the following:

$10000/($100-$15)=118

You have to sell roughly 118 kettles to break even.

When the company will sell 119 kettles, it means the business is profitable.

How to use break even analysis

By performing this analysis, you can understand how many units of product you need to sell to first cover the expenses to break even and then start making a profit. After you calculate your break even, you might understand that you have to make more sales than your marketing and sales can generate. Knowing this is crucial. With this information, you can then work on improving your pricing – perhaps, by increasing the prices or cutting costs, you will then have to sell less to achieve break even.

Also, it can be the case for you that your current model of goods production and sales won't work with the current market demand and the price at which your competitors are offering their products. You might realize you can't reduce the costs and can't increase the price, because you won't be able to compete with other players on the market. This knowledge is also important as it makes sense to not invest in the product and market where competition is too high and you can't be innovative enough to compete.

To summarize, by having this quick simulation and calculating both fixed and variable costs, you can determine your business strategy better so your business succeeds and you start making money.

Wrapping up

Calculating your break even is some kind a simulation you have to make before you even start selling products and announce your pricing to clients. By looking at your fixed costs, variable costs, total costs, calculating contribution margin, and other metrics within break even analysis, you can better understand how much you need to sell to make a profit. All this helps you determine if your business makes sense and understand the sale price at which you have to offer your services and products to the market.

NOTE: InvoiceOcean are not certified income tax or accounting professionals and cannot provide advice in these areas. If you need income tax advice please contact an accountant in your area.