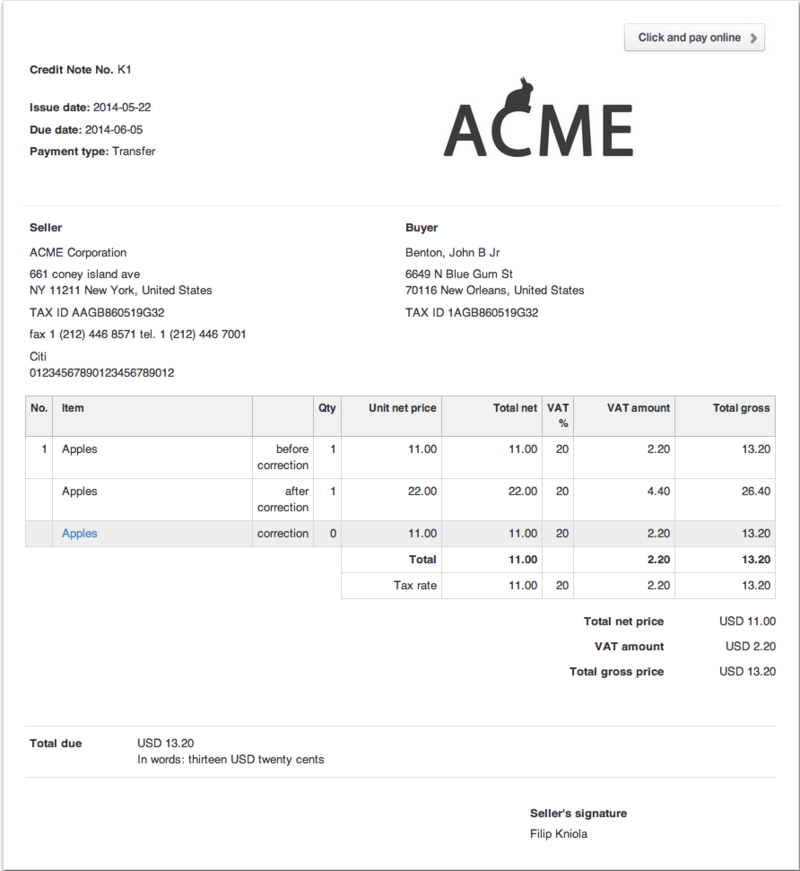

A Credit Note is a document type issued to correct an error which has been made in a sales invoice that's been processed and sent to a customer. Each invoice may be corrected and it is the only proper form of accounting interference. Any type of annotations or corrections on the invoice are not acceptable.

Reasons for issuing a Credit Note:

- Price error: For instance, you have issued an invoice for the amount of $500, where the correct item price was $600. You then issue a Credit Note for the amount of $100 to your customer.

- Short shipment of goods: Customer has been invoiced 10 units, but only 9 of them were shipped. You issue a Credit Note to credit your customer for the shortfall of 1 unit.

- Applying a discount after the invoice has been issued: If you have decided to give your customer a discount after the original invoice has been generated, you may issue a Credit Note with the correct amount after the discount.

- Faulty products or rejected products: In a case of faulty or rejected products, you may issue a Credit Note for the returned goods to correct your Warehouse inventory.

- Price increase: If the price of your product has increased due to certain circumstances, you may issue a Credit Note in order to match the previously charged amount with the current.

- Wrongly shipped products: For instance if you have wrongly invoiced and shipped Product A when the correct item was Product B, you are required to ship Product B along with a Credit Note for Product A as well as another invoice for Product B. That way your Warehouse inventory will be correct.

- Customer short payments: You send your client an invoice for the amount of $200, however, the client only pays $150. You then may issue a Credit Note for the remaining $50 to write-off the shortfall amount.

No credit card required. No commitment. Start your 30-day free trial today!

Sign up for free