You have worked hard to please a client and once you send an invoice, there is radio silence.

No matter how hard you work, with some clients, you will experience a delay in payment.

So what should be your plan?

In this article, we are sharing the tips on writing email reminders to help you get paid for your work faster.

Let's first see what a past due invoice is and how it is different from an outstanding invoice.

What is past due invoice?

A past due invoice is an invoice that a customer hasn't paid after a payment date has passed. Often, the term "past due invoice" is used interchangeably with "outstanding invoice", but there is a small difference between the two.

Outstanding invoices are the invoices that you have issued and a client has to pay, but their payment date hasn't passed yet.

Late payments harm your company's cash flow — in the end, you won't be able to pay your employees and subcontractors unless your clients meet their payment terms in a timely manner.

Clients don't pay invoices on time for various reasons varying from pure forgetfulness to even fraud.

So where should you start to get clients to pay the invoices after their due date? Writing an effective triggered email on late payments is your first step.

We are sharing some templates that work.

Past due invoice email template

Creating an effective invoice template can take time, trial and error on testing them with customers.

Why wasting your time, if you already can use the templates that we have tested out in trenches.

Here we are sharing three past due invoice reminder templates that you can send within the first 14, 30, and 45 days after a client delays a payment and before you decide to work with a collections agency to regain your money.

You can copy this templates for a past due invoices reminder or tweak them a bit to fit your business needs.

To automate the process of sending your first and follow up reminders on past due invoices, consider using InvoiceOceanwhere all fields in a template are populated automatically.

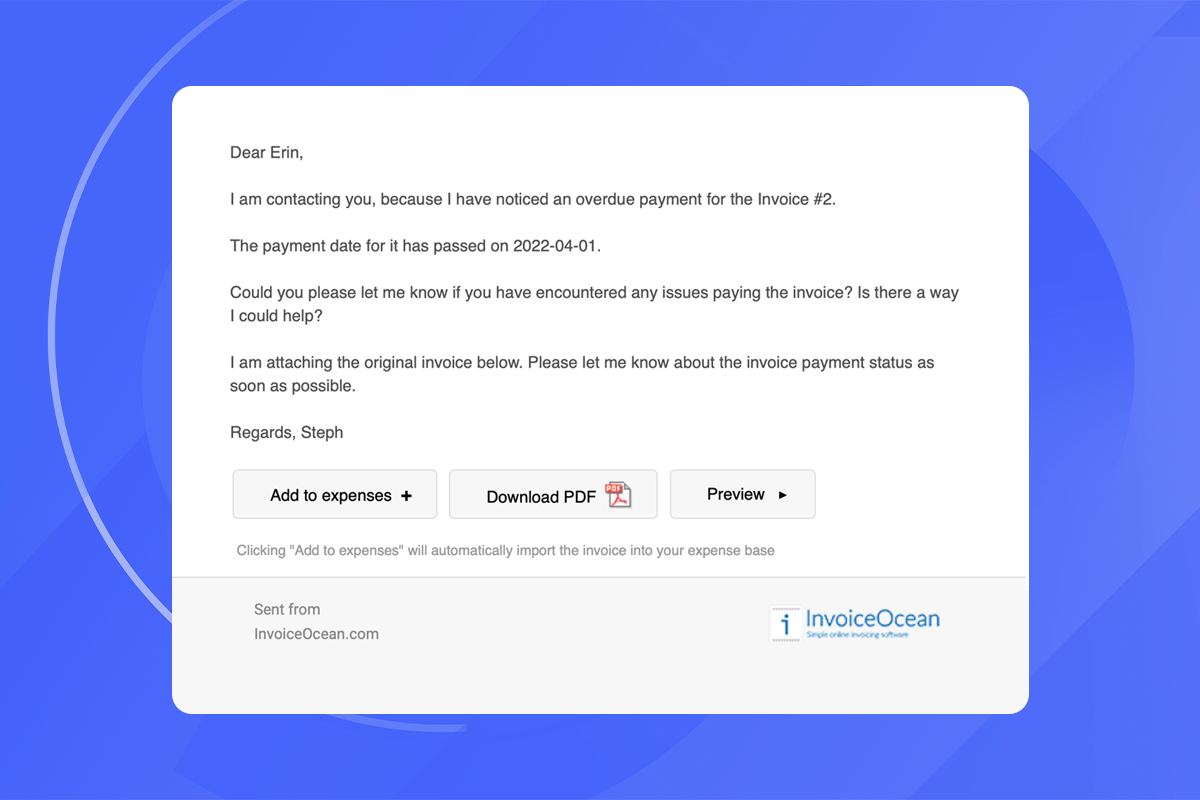

Past due invoice email template — 1-14 days of delay

Subject line: [Company name - Invoice Number] Regarding an overdue payment

Dear [Name],

I am contacting you, because I have noticed an overdue payment for the Invoice [number]. The payment date for it has passed on [date].

Could you please let me know if you have encountered any issues paying the invoice? Is there a way I could help?

I am attaching the original invoice below.

Please let me know about the invoice payment status as soon as possible.

Regards,

[Your Name]

To personalize and send this template automatically, use InvoiceOcean. Here is how a recipient sees your reminder. They can easily add the invoice to expenses, download PDF, and preview the invoice.

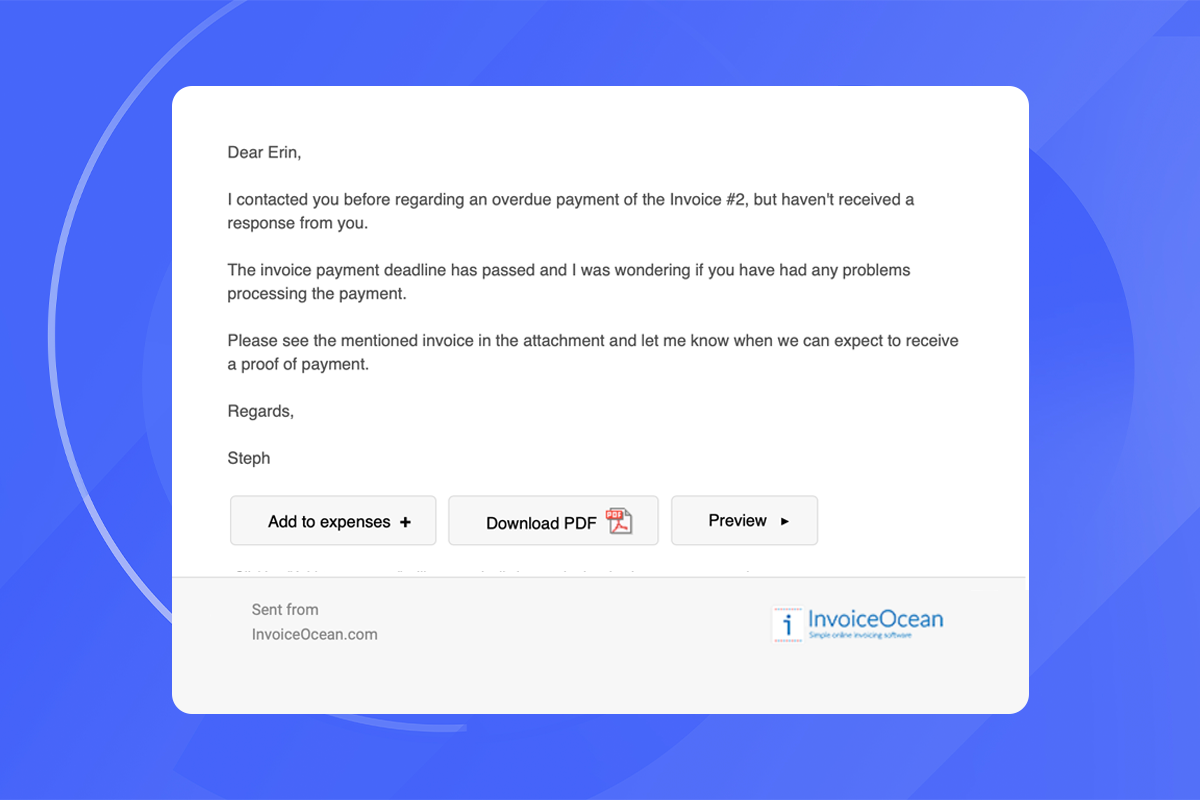

Past due invoice email template — Over 14 days

Subject line: [Company name - Invoice Number] Payment required

Dear [Name],

I contacted you before regarding an overdue payment of the Invoice [Number], but haven't received a response from you.

The invoice payment deadline has passed and I was wondering if you have had any problems processing the payment.

Please see the mentioned invoice in the attachment and let me know when we can expect to receive a proof of payment.

Regards,

[Your Name]

Use InvoiceOcean to personalize and send this template automatically.

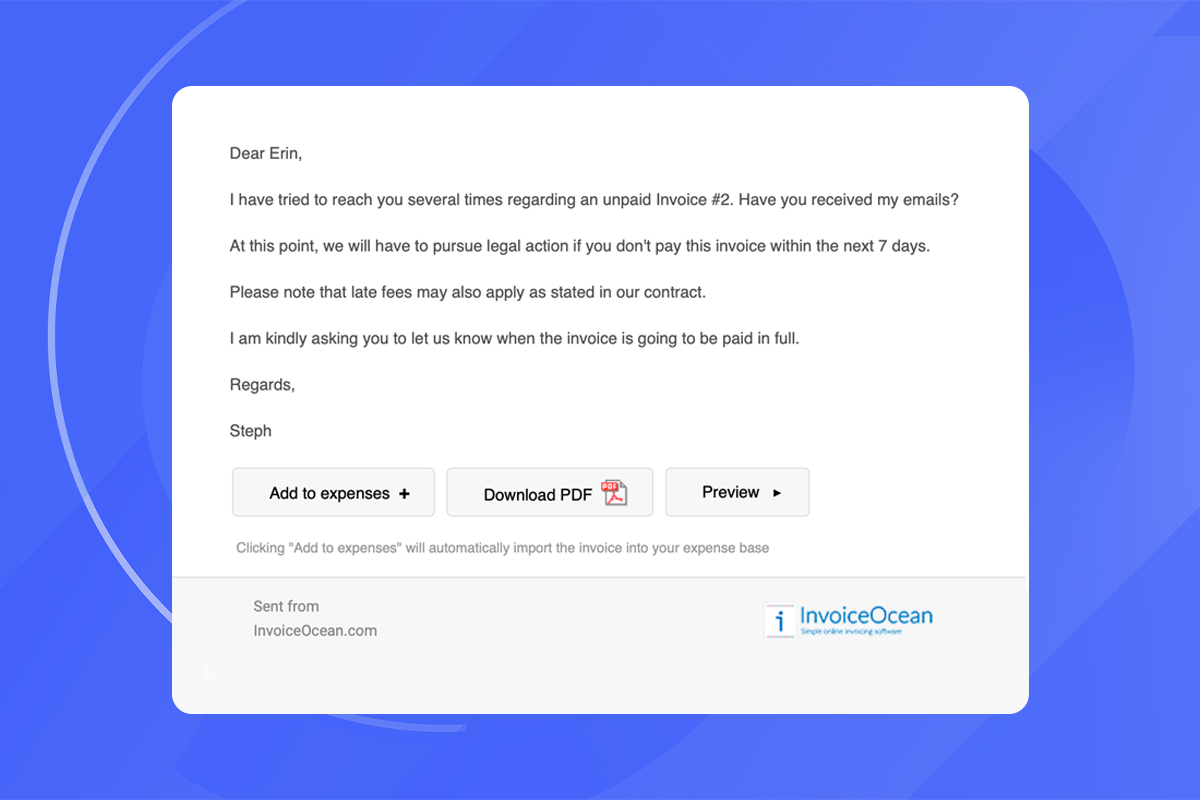

Past due invoice email template — Over 45 days

Subject line: [Company name - Invoice Number] Payment required

Dear [Name],

I have tried to reach you several times regarding an unpaid invoice [Number]. Have you received my emails?

At this point, we will have to pursue legal action if you don't pay this invoice within the next [Number of days].

Please note that late fees may also apply as stated in our contract.

I am kindly asking you to let us know when the invoice is going to be paid in full.

Regards,

[Your Name]

Use InvoiceOcean to personalize and send this template automatically.

How to write a past due invoice email

Using the templates we have shared is your first step to getting clients to pay their overdue invoices.

Remember — sometimes, your invoices can end up in a spam folder and customers won't read them or you can also forget to follow them up at the right time.

Read these additional tips to make your reminders even more effective.

1. Set up automated reminders

Sending follow-up messages on an unpaid invoice can easily go through the cracks. But let's get it straight — following up a client is usually a key to success.

So how can you make it easier for yourself to send follow-up messages?

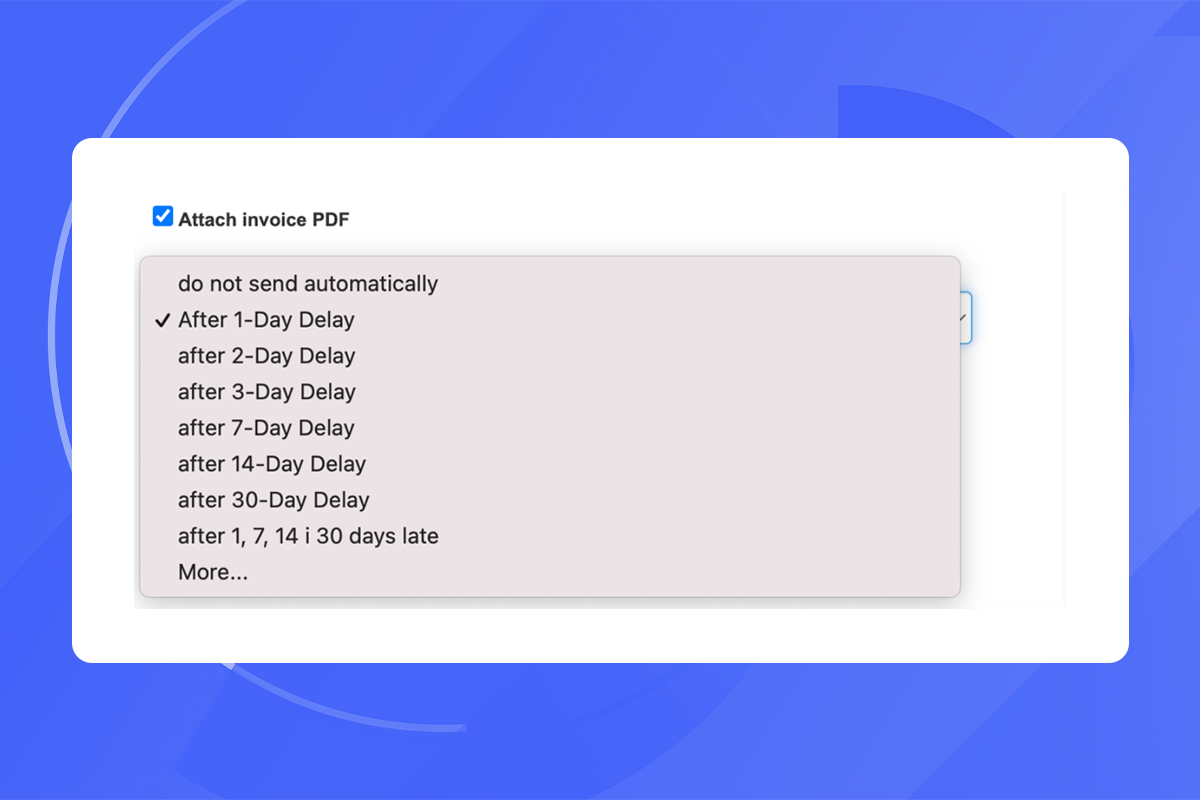

In InvoiceOcean, you can send automated reminders.

You can define how often you want reminders to be sent and modify the text of your email template using an extensive library of modifiers.

2. Include all key information in email

Including the key information about a past due invoice can help your client to perform a transaction.

Imagine you received a request for payment with no information on an invoice based on which a payment should be performed or your bank account details. It would take some time to look through the folders to finally find that invoice.

But not all clients have patience to do it and some of them would simply procrastinate on late payments.

That's why to make it easy for a client to pay, include these information in your invoice reminder:

-

invoice date

-

invoice number

-

the total amount owed

-

the payment terms and any late fees to be charged

-

contact information

You can also attach your invoice in a PDF format.

3. Use the right tone

When clients don't pay, it's easy to get too emotional and even end up writing a rude email.

If you want to keep friendly relations with a client, you have to be polite and use facts as your main weapon.

Your emails should be unemotional, list the details about an issue and prompt action — ask a client to pay an invoice as soon as possible and provide you with a payment confirmation.

4. Late payment fees

Late payment fees discourage clients from missing a payment date of their invoices. Who would want to pay more for the ordered services?

To receive your payment faster, you can charge a late fee the way energy or Internet providers do.

For every day of a delay, you can charge between 1 and 3% of the total invoice amount.

However, remember that you have to include the information about late payment fees in your invoice.

When introducing any changes to the contract, always talk it through with a client.

5. Let clients pay in instalments

If you are working with smaller companies, there is a high chance they sometimes struggle with keeping the cash flow stable.

You can also consider it risky to work with startups, but it doesn't mean you should give up on them.

Sometimes, paying for the project in instalments can solve the problem of late invoice payments for smaller companies.

Divide your project into milestones — key project stages. Once one of the milestones is achieved, you send your client a partial invoice.

Don't proceed with the project further if your invoice hasn't been paid.

When should you follow up a client on a past due invoice?

Do you really have to send a past due invoice email every day?

For many clients, it can be extremely annoying. In most cases, it's enough to send just three reminders.

You can consider to send the first past due invoice email after 1, 7, and 14 days of delay or choose a broader timeframe.

There is no point in sending emails on past due invoices every day — there is obviously some issue in place preventing a client from sending you money. You have to make sure you understand it and help resolve. Applying more pressure won't help.

If a client doesn't react to your third email, it's time to take legal action — go to claims court or a collections agency.

Getting down to work

Dealing with past due invoices can be annoying. However, with the right approach and strategy, you can receive your payment much faster. Being consistent is your recipe to success. By automating reminders on past due invoices, you can regain control and time.

Register for free with InvoiceOcean to personalize and send your reminders on autopilot.