What are prepayments?

There are certain situations where a deposit is required from either buyer or seller. In such cases, you may issue a prepayment invoice, sometimes called a prepaid invoice.

A prepayment invoice is a document used to record advance payments from suppliers or clients. It contains the amount to be prepaid on a sales order and enables you to invoice deposits required from clients or sellers.

Prepayments can be calculated based either on the percentage of the total order or have a fixed amount.

Deposit vs. Prepayment: How is it different?

These two concepts are not the same. A prepayment is some amount that a buyer pays in advance, while the main goal of deposits is securing a transaction. Therefore, a payment made in advance can be considered a prepayment. When a deposit is paid, a payer loses the power of disposition over the money as the funds get frozen on the receiver's account. At the same time, the payer remains an owner of the money paid.

Prepayments - examples of use

Some types of goods and services require a buyer to pay a full price in advance for the goods or services to be delivered. One of the examples are insurance.

Registering prepayments: cash and accrual accounting

If you are using accrual accounting system, a prepayment would be recorded when a financial event occurs – when a bill issued and not when a payment is made. In the case of cash accounting, recording payment takes place when a payment is made.

Prepayment invoice: How to create?

If your business requires receiving payment first before delivering goods and services, you should be sending your clients prepayment invoices.

How can you create a prepayment invoice?

The best option is using an invoicing software to automate the process of associating a prepayment invoice with an estimate or a sales order.

No commitment. No credit card required.

Start 30-day trial

One of the key mistakes small business owners make when issuing an invoice is creating two separate invoices and calculating the remaining sum to be paid on the final invoice manually.

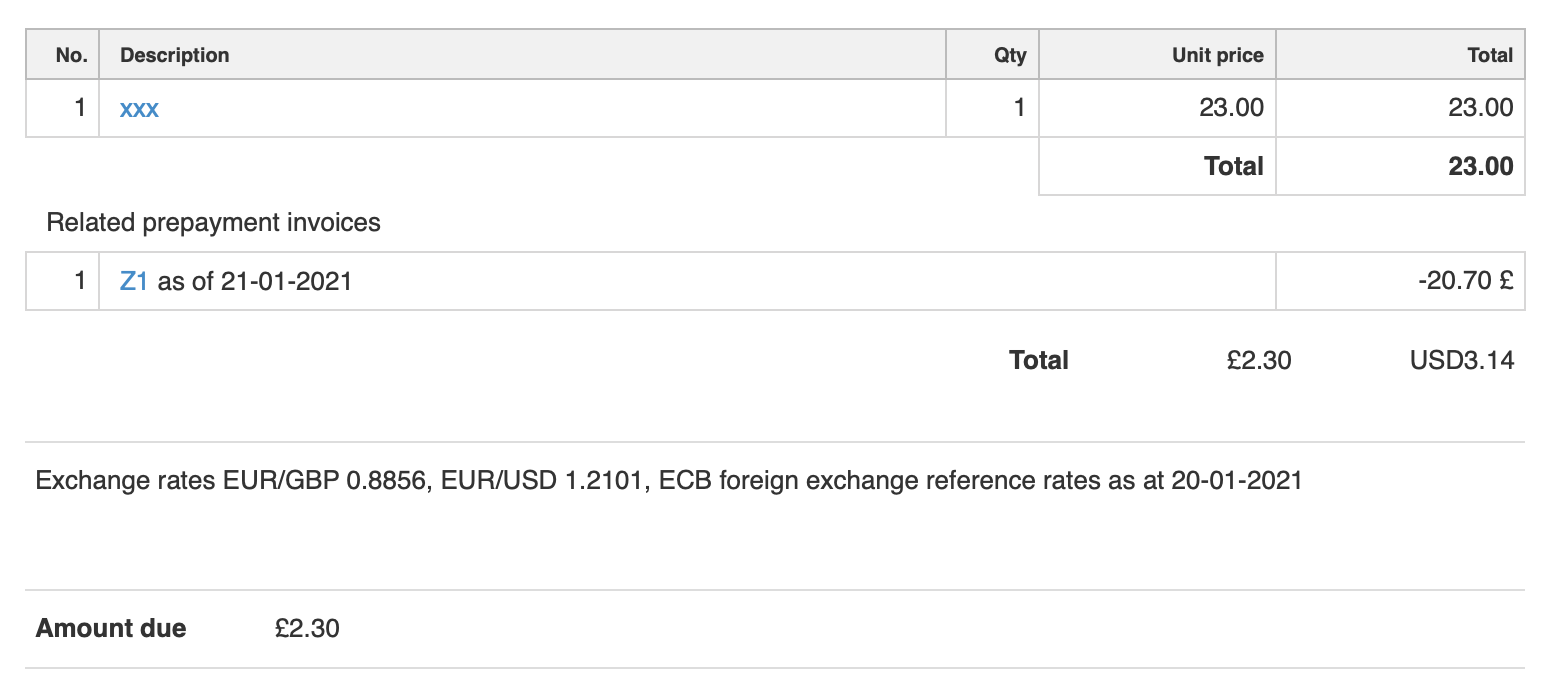

The best solution is issuing an estimate, then a prepayment invoice, and a final invoice. When using an invoicing system that brings this process together, you can generate these documents with a few clicks while the final amount to be paid and an associated prepayment invoice is recorded on your final invoice.

Creating prepayment invoice with InvoiceOcean

Let's take a look how you can create a prepayment invoice with the InvoiceOcean's invoicing software.

Step 1. Issue an estimate for the total amount.

Step 2. Preview that estimate. Then click the Create Prepayment Invoice button (located at the top of the document).

Step 3. When a new window appears, choose a method to calculate the amount. There are three options to choose from:

- % of full amount

- Gross amount

- Issue manually

Step 4. (Optional) Go back to the estimate and issue another prepayment if needed.

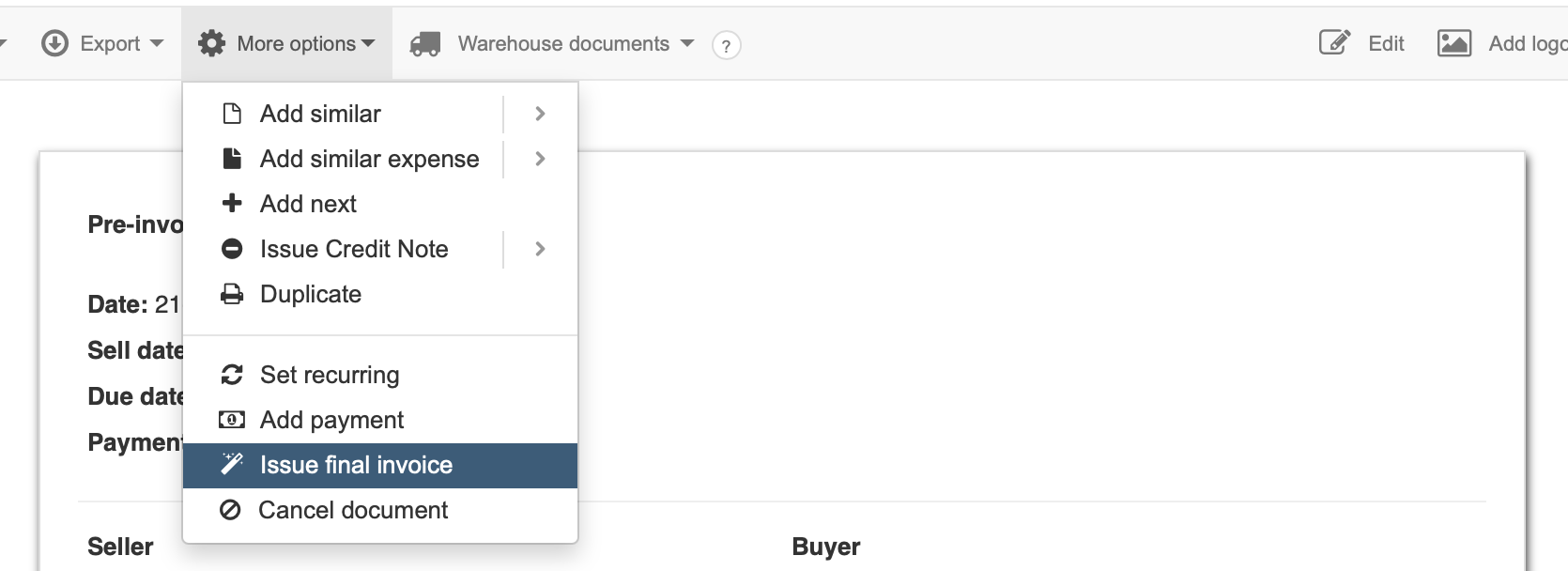

Step 5. Close all transactions by issuing a final invoice.

On your final invoice, you will see that a prepayment invoice was linked and the amount that has not been covered by the prepayment invoice is calculated automatically. The total amount on the document will be subtracted by those prepayment invoices’ amounts.

Automate the process of creating prepayment invoices with InvoiceOcean. Issue your invoices for free!

Start 30-day trial

Prepayment invoicing – final notes

Prepayment invoices are widely used by businesses to get advance payments for the goods and services before they are delivered. Sometimes, the prepayment is set at the full rate – 100%, while in some cases, it is only 30% or 50%. In each case, it is more convenient to streamline the process of creating and associated prepayment invoices with final invoices.

To generate a prepayment invoice, you can use an invoicing software such InvoiceOcean, to easily create and send both prepayment and final invoices.

If you are looking to create a prepayment invoice, you do that for free here.

To generate a prepayment invoice, you can use an invoicing software such as InvoiceOcean, to easily create and send both prepayment and final invoices.