VAT denotes a value added tax and is applicable in over 160 countries worldwide. There are certain rules that apply for issuing a VAT invoice such as paying VAT each time a product or service is bought. In the EU countries, VAT requirements such as rates are defined at national levels, while only general rules stay the same for all member states.

What VAT obligations do businesses from outside of the EU have and how to register for VAT in one of the EU member states? This article explains the most frequently asked questions that non-EU companies can have.

What is a VAT invoice?

VAT invoice is an accounting document that specifies the goods and services sold and subject to VAT. In the EU countries, the period within which VAT invoices are issued should not exceed 15 days of the month in which the goods have been delivered.

How to register for VAT?

You can register in any of the EU countries as a VAT payer. If you trade with more than one EU country, you should register for MOSS (VAT Mini One Stop Shop) to be able to submit tax through a single tax return.

When do you have to issue a VAT invoice?

The requirement to issue a VAT invoice appears in the situation when you are registered as a VAT payer. So when does an obligation to get registered for VAT appear?

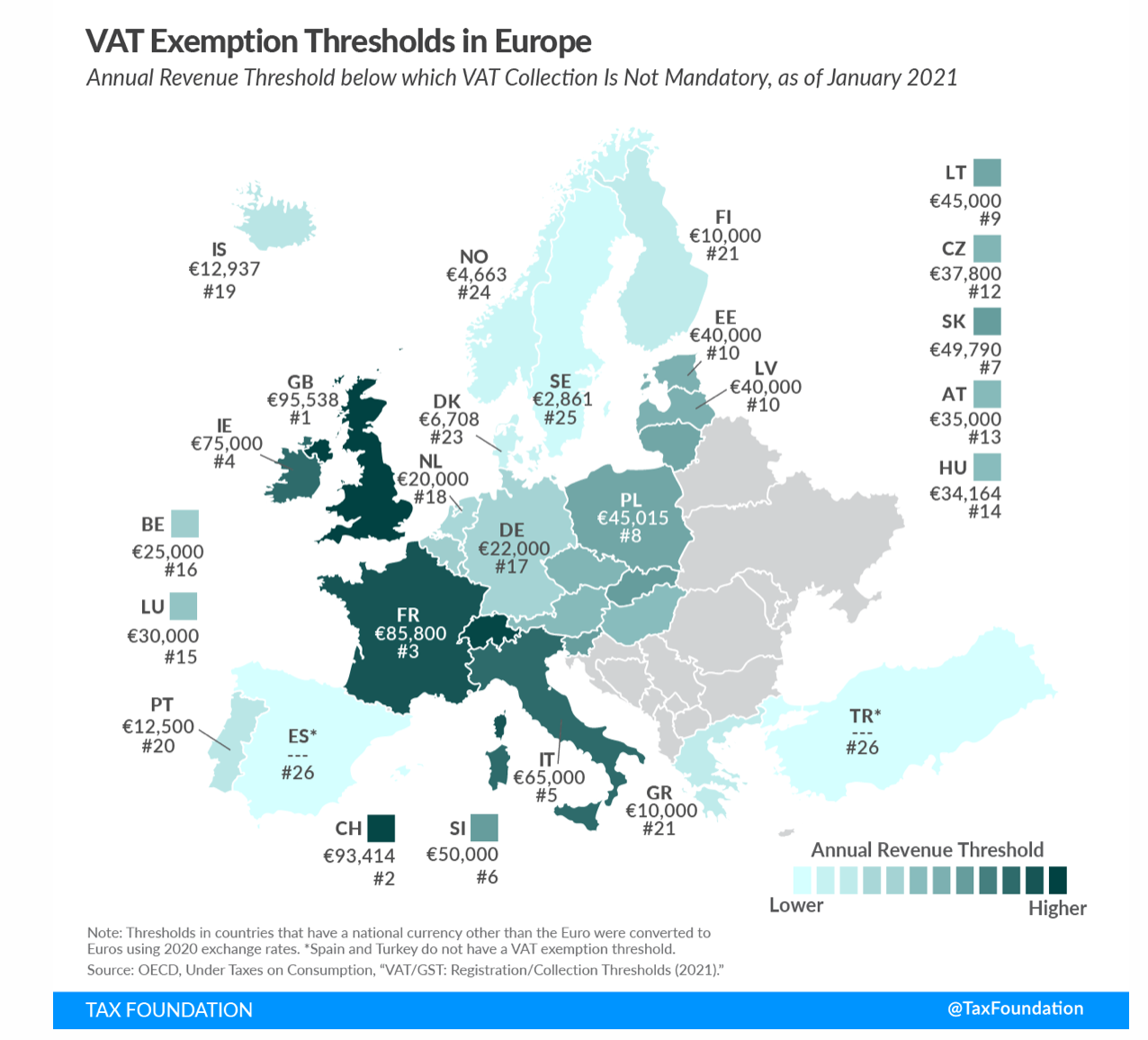

There is no uniform answer as every state applying VAT tax can have different rules on tax thresholds. For example, in the UK the obligation to register as a VAT payer appears when the taxable turnover during the last 12 months exceeds £85,000 in turnover.

To be sure when you have to register for VAT, check the regulations of the country where your company is registered. You can also refer to the following infographic.

VAT thresholds for distant sales

Since July 2021, new rules related to distant sales and VAT came into force. According to the next changes, a business exceeding the threshold of 10,000€ in goods sold has to register for VAT in all countries where goods or services have been supplied after exceeding 10,000€. The first 10,000€ are paid in the country from where you sell.

How to issue a VAT invoice?

In order to create a VAT invoice, you have to include certain information.

What does a VAT invoice need to include?

Here are some obligatory information for VAT invoices:

1) Business name and its address

2) VAT number

3) The invoice date and number

4) The client’s name and address, VAT number if applicable.

5) Information about reverse charge if applicable (if your client is VAT registered)

6) The client’s VAT number, if applicable (the invoice will then be subject to the reverse-charge mechanism outlined above).

7) The VAT rate

8) Total amount charged for each item

9) Total amount due after VAT is added

10) The currency that applies

Where does VAT apply?

EU businesses registered for VAT purposes have the obligation to issue VAT invoices if they are selling to other businesses.

They can choose among two options – create an electronic invoice or issue a paper one. They must include their VAT identification number, VAT amount charged and some other requirements applicable often varying among the EU member countries.

VAT invoices contain a VAT rate added to the price of the goods or services listed.

EU VAT Invoices: Information required to sell goods or services

There are the invoicing rules applicable for each EU country. However, the definition of VAT requirements is subject to the rules of individual EU countries.

Here are general rules applicable in each country.

-

Paperless invoices should be treated the same way as paper invoices.

-

Companies can store invoices in the way they prefer and in the place they choose.

-

Businesses are free to send electronic invoices for an acceptance by a recipient.

If you need to check specific country requirements, visit the official EU website where you can check the requirements for an individual EU country.

Frequently asked questions related to VAT invoices

Value added tax invoices vs. sales invoices – what’s the difference?

Sales tax and VAT are the terms met with a great deal of confusion among business owners so let’s debunk it!

Sales taxes are paid at the final stage of a supply chain by a retailer when goods and services are bought. Sales tax is not collected if the goods are resold. This obligation appears when a sale reaches its final stage and the product lands in the hands of a consumer.

In contrast, VAT is paid at each stage of a supply chain. Suppliers, manufacturers, distributors, and retailers should be paying VAT.

What is not a VAT invoice?

VAT invoices are issued when a sale happens, therefore, the documents such as proforma, order confirmation, quote are not considered VAT invoices.

What is a proforma invoice?

Proforma invoices are documents indicating the prices for goods or services and are issued before payment is made.

What is order confirmation?

Order confirmation as documents don’t provide sufficient evidence to claim VAT. Their goal is to show order acknowledgement. They can be an indication of business spend.

What is a quote?

Quotes mean an estimated price for goods and services. VAT can’t be recovered on such documents as a quote is only a commitment to a price – a buyer should still decide if to place an order with a company that sent the quote.

To wrap it up, VAT invoices are issued when a sale takes place and an obligation for payment appears. Such invoices confirm how much of VAT is due to be paid.