There are various market solutions available for businesses to tap into when it comes to invoicing. They all come with their own perks, upsides and downsides. Each also usually comes in the form of various payment plans available and price points per plan. Here is a comparison of InvoiceOcean UK’s pricing structure with that of some of our biggest competitors

|

Pricing |

Free Plan |

Medium Plan(s) |

High-End Plan |

|

InvoiceOcean |

Yes |

£5.59/£10.39 |

£19.99 |

|

Currently on discount |

|||

|

Intuit Quickbooks |

No |

£3/£7 |

£11 |

|

Currently on a very large discount |

|||

|

Xero |

No |

£10/£22 |

£27.5 |

|

Standard pricing |

You may be wondering why another large competitor, Freshbooks, is missing. Freshbooks is more of a U.S.-focused company; although it is very popular in the UK and worldwide, their pricing scheme reflects the U.S. dollar and U.S. businesses overall. Thus, for this comparison we will be focusing on these three companies above. Plus, if we were to list all the major players the list would be quite large so for now we will be focusing on the invoicing solutions common to the UK. We also will focus on few key metrics we know U.K users are looking for in their invoicing solutions: such as currency conversion or multiple currencies within an invoice. We know many UK users and firms are constantly dealing with the EU, and other EU-based businesses. This alone requires UK businesses to have good currency conversion and other options. So with that said, here are some additional metrics to consider and our comparison:

|

Monthly Invoice Limit |

Free Plan |

Medium Plan(s) |

High-End Plan |

|

InvoiceOcean UK |

3 |

Unlimited / Unlimited |

Unlimited |

|

Intuit Quickbooks |

N/A |

Limited in formats |

Unlimited |

|

Xero |

N/A |

5 / Unlimited |

Unlimited |

|

Multiple currencies with conversions |

Free Plan |

Medium Plan(s) |

High-End Plan |

|

InvoiceOcean UK |

Yes |

Yes / Yes |

Yes |

|

Intuit Quickbooks |

N/A |

No / Yes |

Yes |

|

Xero |

N/A |

No / No |

Yes |

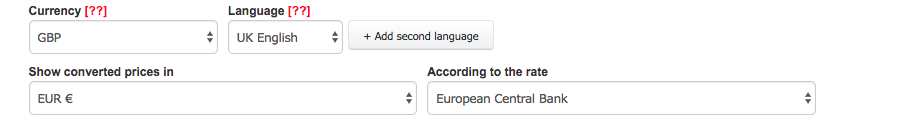

The funny thing about this option though is how the differently systems have such different systems at play and this related to the invoice industry as a whole. For instance, once you turn multiple currencies on as an option in Quickbooks, you cannot turn it back off again. You have to go to settings than advanced settings and it is difficult to find and click on manage currencies to do exchange rate changes. Here you can see how Xero explains its conversion rate process and the way it works. As you may notice it is not as easy to set up or use as InvoiceOcean's, which allows you to choose conversions or multiple currencies right on the invoices themselves you create. Here is an example below:

More metrics below:

|

Tax or Vat rate flexibility |

Free Plan |

Medium Plan(s) |

High-End Plan |

|

InvoiceOcean UK |

Yes |

Yes / Yes |

Yes |

|

Intuit Quickbooks |

N/A |

No / Yes |

Yes |

|

Xero |

N/A |

Yes / Yes |

Yes |

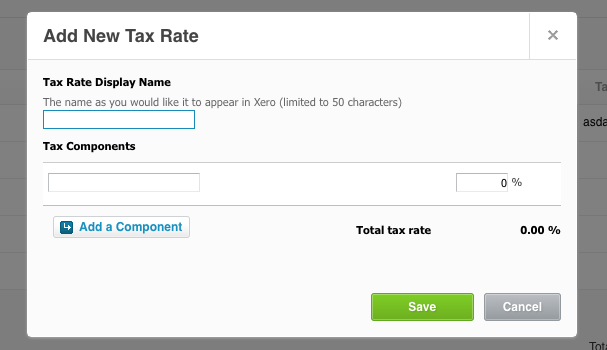

Although all the systems offer various ways to change the VAT rates depending on goods, services or items being sold as well as countries the invoices are being sent from, some are easier than others. InvoiceOcean offers a quick pull-down menu where right on the invoices users can set their own rates. They can also go to settings and choose an additional tax to add onto an invoice like a country or city tax.

No commitment. No credit card required.

Start 30-day free trial

Xero, for instance, is more complicated as you have to input a bunch of fields: tax component, name and rate in order to add your own tax unless you choose one from the pull-down menu which is tied to your region where you live. Here is how Xero's system looks like when trying to add a default or different rate (note that Quickbooks also requires you to set up a tax rate and fill in a form from the main settings menu and not within an invoice):

more metrics below:

|

Users Supported within account |

Free Plan |

Medium plan(s) |

High-End Plan |

|

InvoiceOcean UK |

1 |

1 / 3 |

Unlimited |

|

Intuit Quickbooks |

N/A |

1 / 3 |

5 |

|

Xero |

N/A |

Additional costs per user added |

Additional costs per user added |

|

Accepts Various Online Payments |

Free Plan |

Medium Plan(s) |

High-End Plan |

|

InvoiceOcean UK |

Yes |

Yes / Yes |

Yes |

|

Intuit Quickbooks |

N/A |

Limited / Yes |

Yes |

|

Xero |

N/A |

Yes / Yes |

Yes |

You can also connect a bank account or credit card directly within Quickbooks by linking the banking system from the user bank's website to the Quickbooks system or website/web app. Another important thing for UK users is being able to make sure that they are paid as there are many freelancers and entrepreneurs in the UK working with companies overseas. InvoiceOcean offers both unpaid invoice reminders via email as well as the ability for users to add recurring invoices. However, keep in mind that InvoiceOcean only offers unpaid invoice reminders via email starting with the Basic or second plan and recurring invoices with the third or Professional plan. Likewise, Quickbooks only offers this option with a limited amount of their plans: Essentials and Plus.

|

Ability to issue recurring invoices |

Free Plan |

Medium Plan(s) |

High-End Plan |

|

InvoiceOcean UK |

No |

No / Yes |

Yes |

|

Intuit Quickbooks |

N/A |

No / Yes |

Yes |

|

Xero |

N/A |

Yes / Yes |

Yes |

Overall, you may notice that InvoiceOcean UK truly stands out in features and price. It also has more option with an additional fourth tier than the others in this comparison that come with three. There are obviously things each system specializes and excels in, however we figured these metrics are what UK users are looking for so we presented the comparison with them in mind. The other thing to keep in mind is ease of use. InvoiceOcean allows you to do a lot of the things the other options only allow through complicated menus and settings right on the invoice itself. InvoiceOcean has way more options within invoices for users and although this may make the invoice submission process a bit more cluttered, most of these options can be ignored if you choose to and may not be listed in the final invoice if you do that. Either way, more options for users and ease of use are things InvoiceOcean strives to provide for its clients.

When a UK business interacts with the European union -- whether other businesses or financial institutions or entrepreneurs -- the invoicing needs to cover things like the currency conversions from Pounds/Sterlings to the Euros as well as the VAT. That is again a reason we did a comparison of these companies with a UK focus and did not focus on competitors that may not have a UK or EU system in place.

UK companies also oftentimes rely on online payment processing and all three of these systems we compared have a nice variety of payment processors integrated. Intuit is unique in the sense it offers ACH bank transfers and eCheck integration. Paypal and various mobile payment methods such as ApplePay or Google’s alternatives are also gaining ground in the UK and most of the payment systems offer one form or another of such a payment.

Using other metrics like the monthly user limit and monthly invoice limit are important to businesses worldwide. Because depending on a company’s size, a company may only need to send out a certain amount of invoices monthly or want a plan that guarantees unlimited invoicing. It will depend on the size of the company and industry it is operating in. All of these things vary and that is why we at InvoiceOcean UK have four (and not just three) tiers of plans available and unlike most competitors, we include a free plan for freelancers or those only needing a limited amount of invoicing.

By the way, you may be wondering where we got these numbers from. So here are the pricing and feature tiers listed on all of the analyzed companies' websites: InvoiceOcean UK, Xero and Intuit Quickbooks. We also tested each software to make sure they follow the feature lists they boast. The features and prices were compared on on 11/12/18.