Invoicing software

Discover a simple online invoicing software

Multiple templates, custom logos, multiple currencies and fast payments. Discover all the features that make invoicing easier.

Try it for freeInvoices online

Now you can access your documents anywhere in the world. All you need is any computer and internet access. Invoicing is possible anywhere: on business trip, on holiday or in a client meeting. This is especially important in times of mobility and remote working.

You don't have to worry about data security. Our online invoicing software ensures that your invoices and customer data are stored on secure servers protected by an SSL certificate.

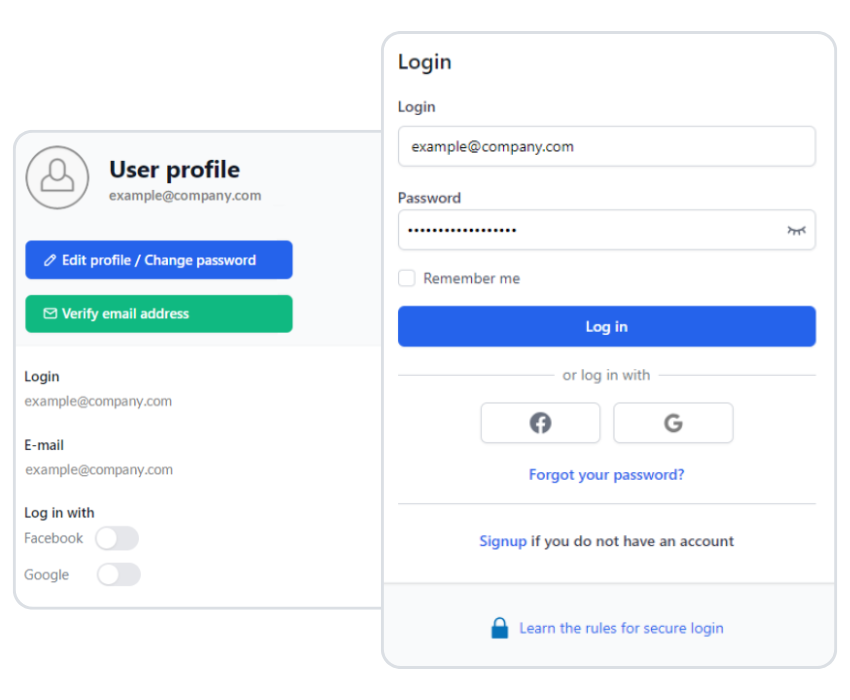

- Secure system

- Access to the administration panel is secured by a login and password that only you know.

- Forgot your password?

- If you forget your password, the system will easily tell you how to reset it.

Check out the options of InvoiceOcean!

Try it for free for 30 days. No installation fees or long-term commitments.

Try it for free